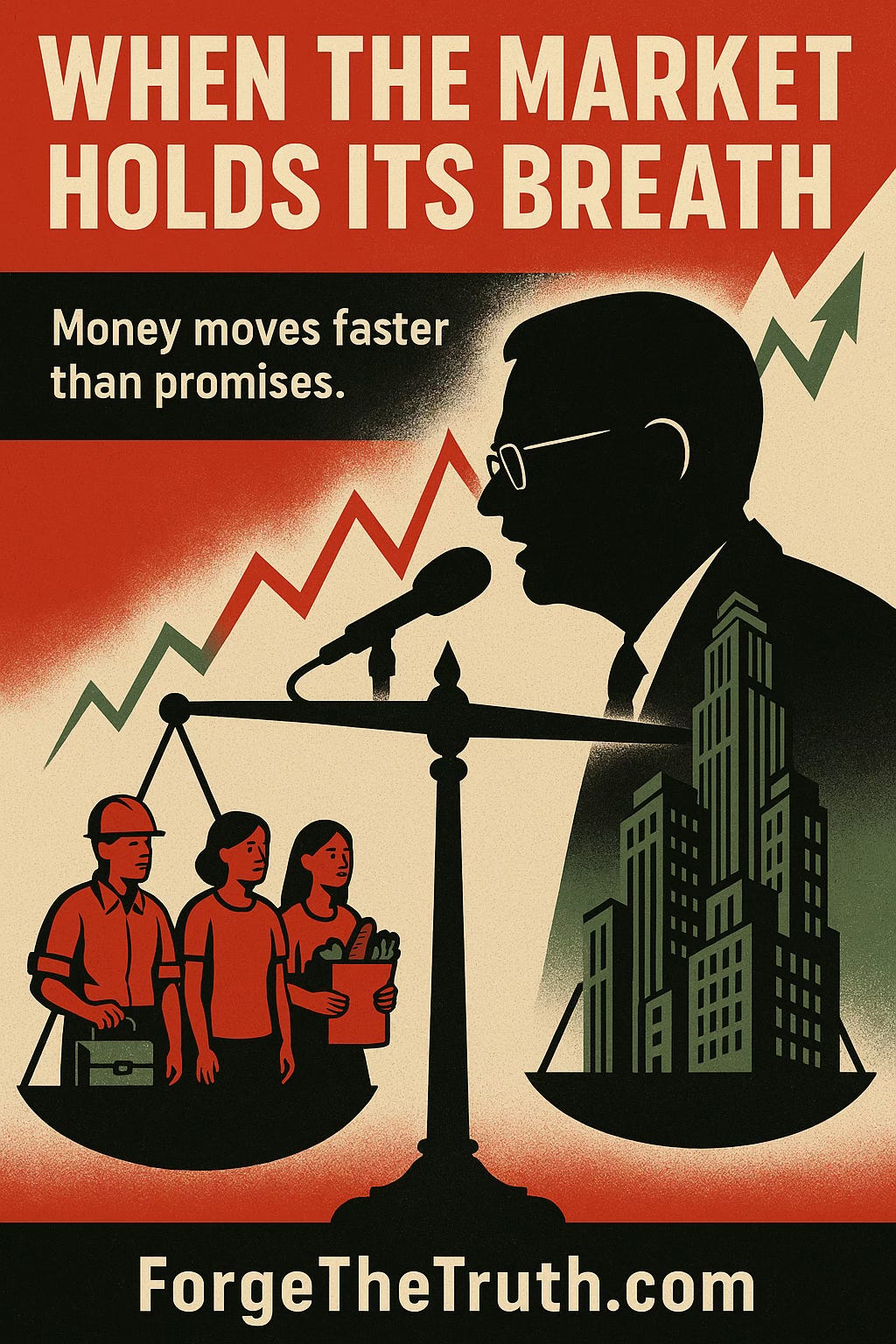

When the Market Holds Its Breath

Money moves faster than promises.

Dateline: Jackson Hole, Wyoming - August 22, 2025

Markets don't wait. The instant Jerome Powell hinted at possible rate cuts this fall, Wall Street surged. The Dow, S&P 500, and Nasdaq leapt upward in minutes. Bond yields slipped. The dollar wavered. And once again, trillions shifted on the breath of a single man.

But while money moves faster than promises, lives do not. For families balancing rent, groceries, or student debt, Powell's carefully phrased optimism brings no instant relief. Wages don't leap with stock charts. Grocery prices don't tumble when bond yields dip.

The spectacle of global markets reacting like a flock of startled birds shows us the fragility of our system. One speech can unleash euphoria for investors, but leaves workers standing in the same checkout line, hoping next week's paycheck will stretch further.

The divide is clear:

Wall Street soars at the hint of relief.

Main Street waits for the promise to arrive.

As we watch the scales tilt with every Federal Reserve whisper, we must ask: Who benefits from this speed? And how long can a society sustain itself when markets are rewarded instantly while its people are told to wait?

This week's news reminds us that economics is not neutral. It is political, human, and deeply unequal. The Fed can move the levers, but it is up to us to demand a system where prosperity isn't just a chart but a shared reality.

ForgeTheTruth.com - Where art becomes action.

Further Reading