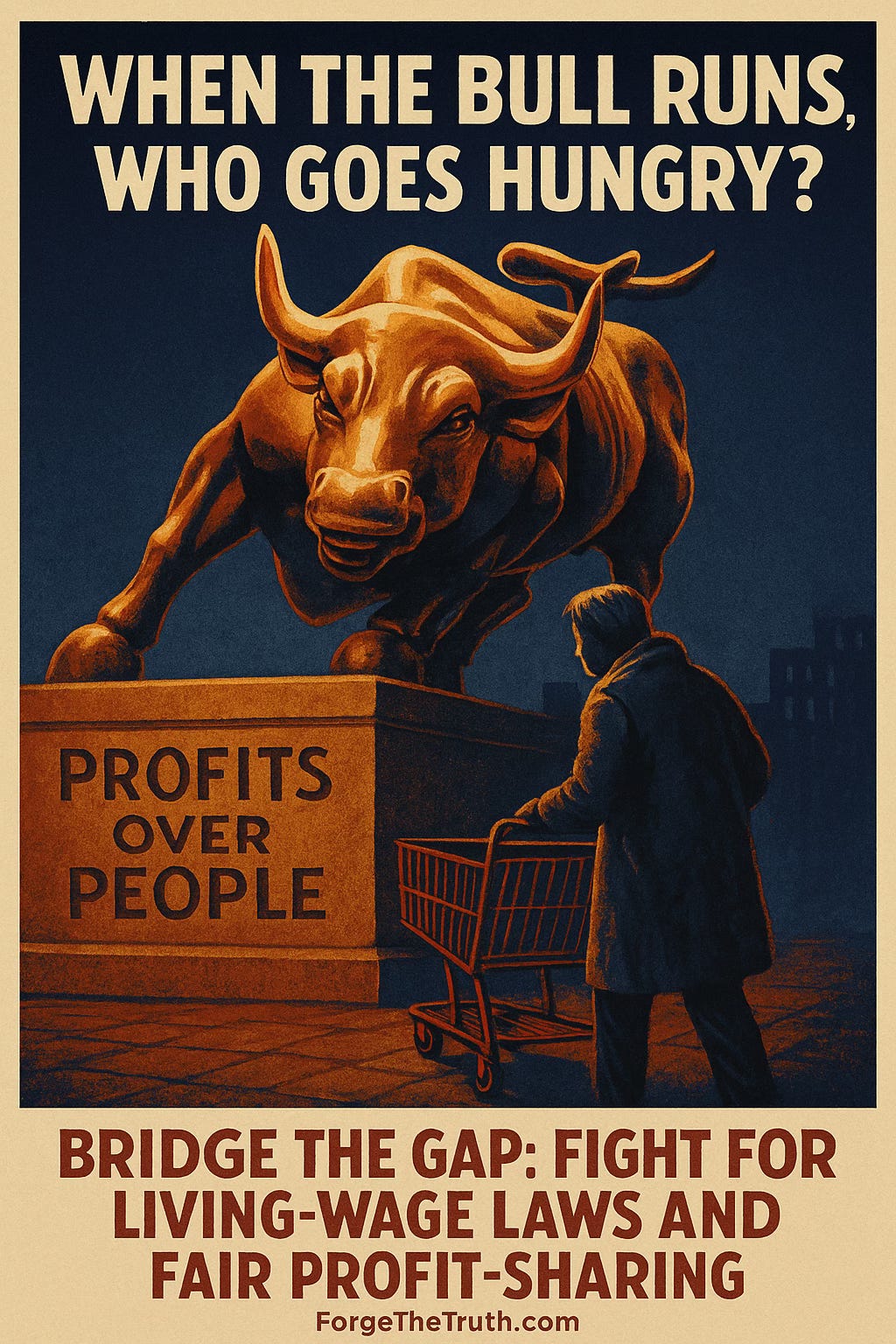

When the Bull Runs, Who Goes Hungry?

Markets smash records while living costs climb. Here’s why soaring share prices feel hollow on Main Street.

The Rally

Wall Street, New York, June 30 2025 - Wall Street opened at fresh all-time highs this morning. The S&P 500 and Nasdaq hit new records on optimism over looming trade deals.

Corporate after-tax profits remain near the top of the chart. The Bureau of Economic Analysis shows profits rose 7.9 percent in 2024 and, despite a small dip in the first quarter, are still hovering close to record territory.

The Reality Check

Grocery pain: Food-at-home prices increased another 0.3 percent in May 2025, marking the second straight monthly rise.

Housing squeeze: The S&P CoreLogic Case-Shiller National Home-Price Index now sits about 50 percent above its 2019 level.

Household mood: A Gallup poll finds a record 53 percent of Americans saying their finances are getting worse, the bleakest reading since the measure began in 2001.

These numbers tell one story: profits compound while paychecks lag, stretching the gap between Wall Street and the dinner table.

Why It Matters

Stocks measure shareholder fortunes, not rent, groceries, or the freedom to plan a future without fear of the next price spike. A record market with record anxiety erodes civic trust faster than any bear trend.

What We Can Do

Back living-wage legislation. Index minimum pay to inflation so work keeps pace with prices.

Tie executive bonuses to median worker pay. Shareholders can insist that compensation grows only when everyone benefits.

Support mutual-aid networks. While policy change moves, neighbors still need full fridges today.

Take Action Today

Share the poster above. Post it on Instagram, X, or your community bulletin board. Tag local representatives and ask where they stand on closing the gap between record profits and everyday survival.

Prosperity is real only when everyone can taste it.

ForgeTheTruth.com